your contributions

When you participate in the PepsiCo Savings Plan, you decide how to contribute to the plan.

Pre-tax (traditional) contributions

You can elect pre-tax contributions, meaning a portion of your pay is taken out and invested into your Savings Plan account before taxes are applied. This reduces your current taxable income. You will pay taxes when you withdraw the funds from your account.

Roth contributions

You can elect Roth contributions, meaning a portion of your pay is taken out and invested into your Savings Plan account after taxes are applied. This means, subject to IRS rules, you will not have to pay taxes when you withdraw the funds from your account in retirement. You also won't pay taxes on any investment earnings.

Limits for pre-tax & Roth contributions

You can contribute up to 50% of your eligible pay each pay period, up to the IRS annual limit. In 2024, this amount is $23,000.

You can save an additional $7,500 each year if you're age 50 or older.

Annual limits are monitored by PepsiCo payroll. If you reach the maximum annual contribution, your 401(k) payroll deduction will automatically stop and restart the following January. If you are age 50 or older this year, your annual savings limit will be increased to include this additional savings opportunity.

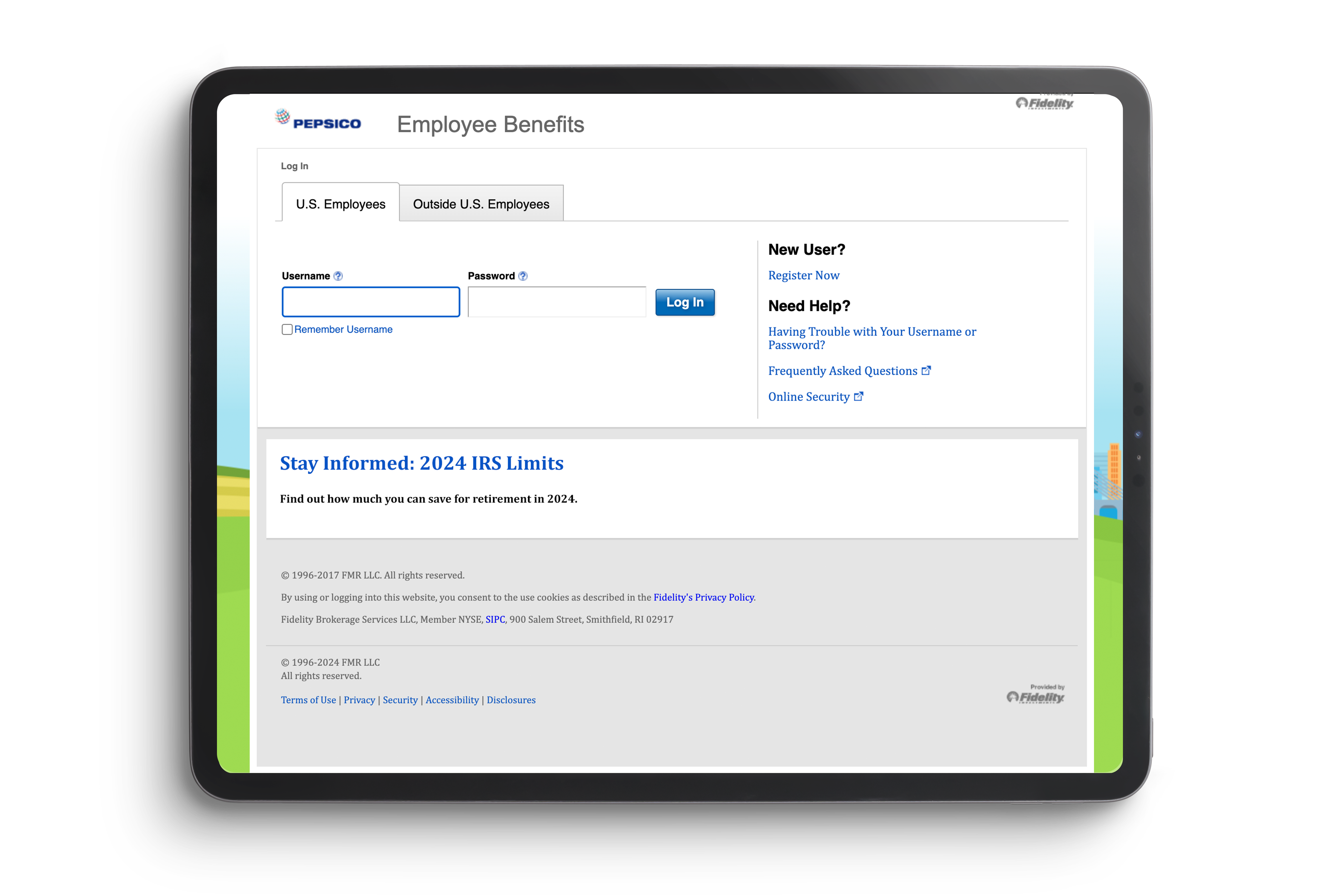

Stay up to date on your retirement account 24/7

Anytime, from anywhere, simply log on to netbenefits.com/pepsico.

Haven't yet registered? It just takes minutes!

After-tax contributions

The after-tax savings option provides a convenient way to save for any type of expense or long-term goal. Contributions are automatically deducted from your paycheck each pay period using after-tax dollars and deposited into your Savings Plan account. While there are no tax advantages to making after-tax contributions (you'll need to pay taxes on any investment earnings when you withdraw the money), after-tax contributions can be withdrawn at any time without penalty.

Limits for after-tax contributions

After-tax contributions are limited by the IRS-defined Annual Additions Limit, which is $69,000 in 2024 (or $76,500 for employees over age 50). This means all 401(k) contributions, including employee contributions (like pre-tax, Roth and after-tax) plus Company-funded contributions (like PepsiCo Retirement Contribution, and Company match) cannot exceed $69,000 (or $76,500 for participants over age 50) in 2024. This limit is separate from the pre-tax and Roth contribution limit described above.

While your pre-tax and/or Roth contributions will be stopped once you reach the $23,000 limit (or $30,500 for participants over age 50), your after-tax contributions will continue and will not automatically stop once you reach the Annual Additions Limit. You'll need to monitor your contributions to ensure you do not go over the Annual Additions Limit. If your after-tax contributions exceed the Annual Additions Limit, you will receive a refund of excess contributions, per Plan rules.

Finally, further limits apply for highly compensated employees (HCEs), as defined by the IRS. HCEs cannot defer more than 10% of their pay in after-tax contributions.

Annual Increase Program

The Annual Increase Program allows you to set regular annual increases to your contribution amount. You may elect an increase date and percentage when you enroll. You may increase your contributions by 1% or more each year, automatically, as long as doing so falls within the Savings Plan's contribution limit on pre-tax and Roth contributions.

Vesting

You will always be 100% vested in your contributions and investment returns on your contributions. This means if you were to leave PepsiCo, any contributions you made to the Savings Plan are yours to take with you.

![]()

- QUICK LINKS

- Home

- The PepsiCo 401(k) Savings Plan

- Your contributions

- PepsiCo matching contributions

- Investing your contributions

- Getting your money out of the Savings Plan

- PepsiCo Retirement Contribution (PRC)

- Contacts and links

This guide is intended to provide a summary of some of the features of the PepsiCo Savings Plan; however the official plan documents remain the final authority and, in the event of a conflict with this guide, will govern in all cases. While PepsiCo, Inc. (Company) currently intends to continue the Savings Plans and programs described herein, the Company reserves the right to amend, modify or terminate the Savings Plans or programs at any time. Nothing in this guide should be construed as a promise or guarantee of future benefits or any level or amount of benefits, or as a promise or guarantee of employment or future employment for any duration.

January 2024